2024 1040 Schedule 502 Instructions

2024 1040 Schedule 502 Instructions – The 1099 forms are sent to you by clients you work for. Complete IRS form 1040 “Schedule C, Profit or Loss From Business.” Complete IRS Form 1040 Schedule SE, “Self-Employment Tax.” . To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are .

2024 1040 Schedule 502 Instructions

Source : sites.google.com2022 irs instructions 1040 form: Fill out & sign online | DocHub

Source : www.dochub.comIndependent Restoration Services Kentuckiana | Louisville KY

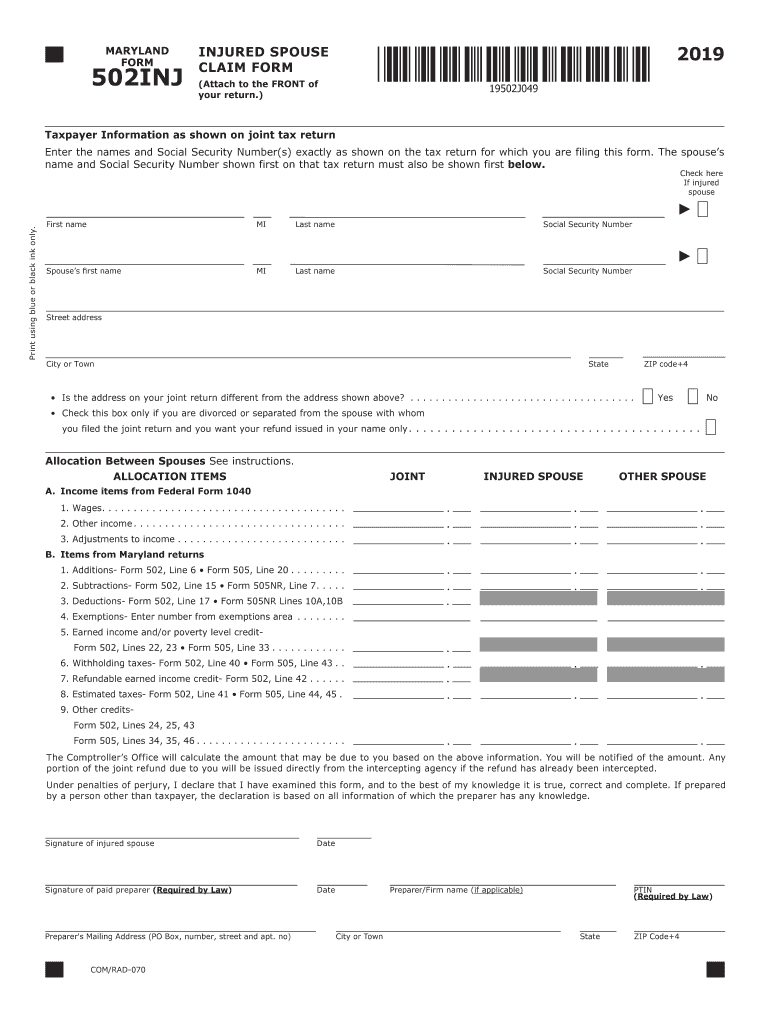

Source : www.facebook.comMaryland claim 502: Fill out & sign online | DocHub

Source : www.dochub.comAbout Publication 502, Medical and Dental Expenses | Internal

Source : www.irs.govEZ TAX LLC | Frankfort KY

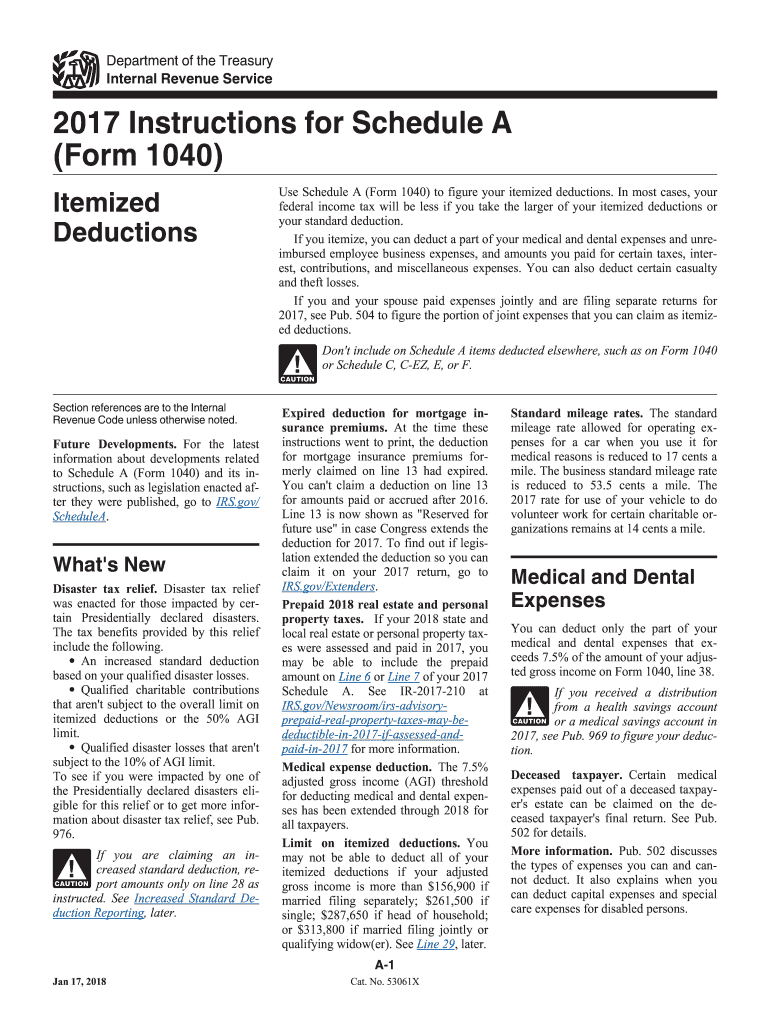

Source : m.facebook.com2017 form 1040 instructions: Fill out & sign online | DocHub

Source : www.dochub.comSunrise and Sunset Times Apps on Google Play

Source : play.google.comIrs gov 1040 forms and instructions 2018: Fill out & sign online

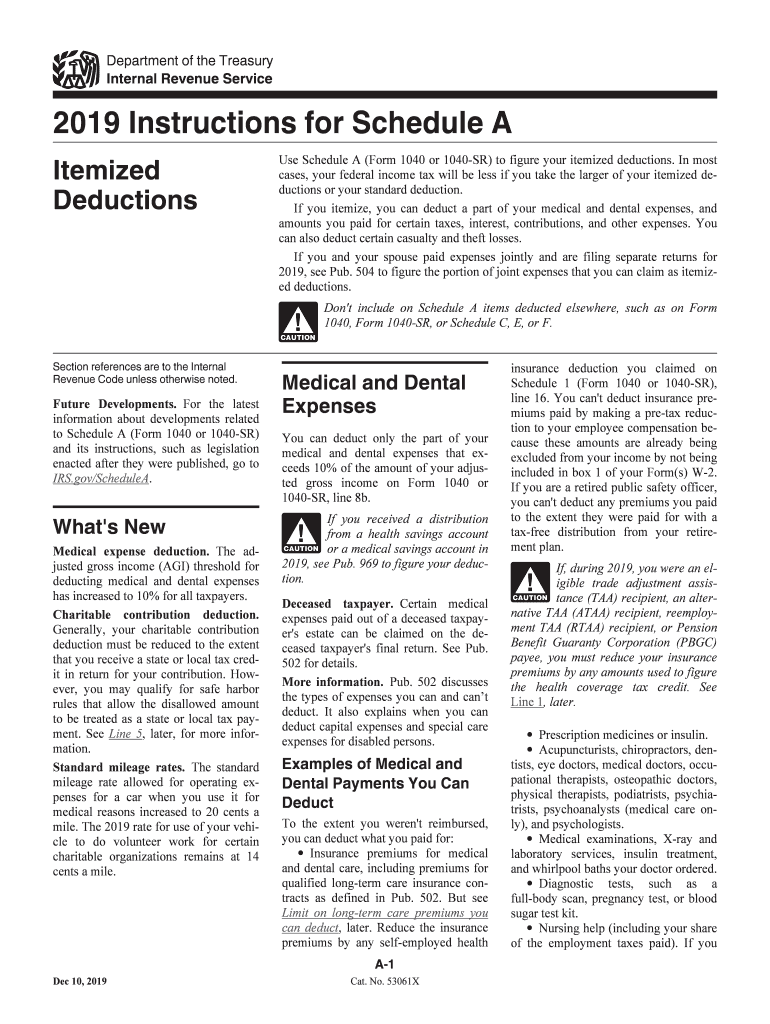

Source : www.dochub.comPublication 502 (2023), Medical and Dental Expenses | Internal

Source : www.irs.gov2024 1040 Schedule 502 Instructions Federal Income Tax Spreadsheet Form 1040 (Excel Spreadsheet : The person reporting the interest income must include the name, address and Social Security number of the person paying or receiving the money on line 11 of Form 1040, Schedule A. IRS Publication . Use Schedule 1 to report above-the-line deductions For more information on above-the-line deductions, read the instructions for Form 1040 on the IRS website or consult your tax advisor. .

]]>